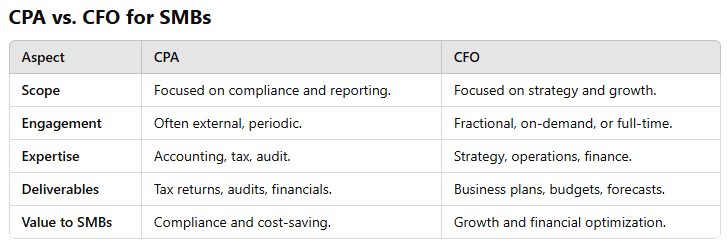

The difference between a CPA (Certified Public Accountant) and a CFO (Chief Financial Officer) lies in their roles, focus areas, and how they contribute to a small or medium business (SMB). While both are critical for financial management, their responsibilities and expertise serve different purposes.

Certified Public Accountant (CPA)

Focus: Accounting, compliance, and financial reporting.

Primary Responsibilities:

- Ensuring compliance with tax laws and regulations.

- Preparing and filing tax returns.

- Conducting audits and ensuring accurate financial reporting.

- Offering general accounting and bookkeeping services.

- Providing advice on tax strategies to minimize liability.

Specialization:

- CPAs are trained to handle the technical aspects of accounting, including GAAP (Generally Accepted Accounting Principles), tax laws, and audit standards.

Key Contribution to SMBs:

- Ensuring the business remains compliant with regulatory requirements.

- Reducing tax liabilities through strategic tax planning.

- Providing accurate financial records for decision-making or securing loans.

Engagement:

- Often engaged on a project or periodic basis (e.g., during tax season or for an annual audit).

Chief Financial Officer (CFO)

Focus: Strategic financial management, planning, and business growth.

Primary Responsibilities:

- Developing and implementing financial strategies aligned with business goals.

- Managing cash flow, budgets, and forecasting.

- Analyzing financial data to guide decision-making.

- Overseeing investments, fundraising, and capital allocation.

- Leading risk management and financial reporting processes.

- Advising on mergers, acquisitions, or major business decisions.

Specialization:

- A CFO focuses on the bigger picture, blending financial insight with operational strategy to drive growth and improve profitability.

Key Contribution to SMBs:

- Helping businesses scale and navigate financial complexities.

- Improving operational efficiency and profitability.

- Ensuring sustainable growth through strategic planning and risk management.

Engagement:

- Can be full-time, fractional, or on-demand, depending on the business size and needs.

Which Should SMBs Choose?

- Both: SMBs benefit from having both a CPA and a CFO, as their roles complement each other. A CPA ensures compliance and financial accuracy, while a CFO leverages this information to drive strategic decisions.

- When to Prioritize a CPA: Tax season, audits, or financial statement preparation.

- When to Prioritize a CFO: Scaling operations, financial strategy, or navigating complex decisions like securing funding.

For SMBs with limited resources, engaging a fractional CFO or a CPA with advisory skills could be a cost-effective way to get the best of both worlds.